Discover ways to enrich your furry friends’ lives with this informative article. From engaging toys

Decentralized finance (DeFi) promises to revolutionize traditional banking and finance by providing open, transparent, and

Not that Lisbon is the worst place to be stuck on your own, not unless

A swimming pool situated in the backyard is a long-cherished desire for numerous householders. It

Have a short, long, or medium-term strategic business vision. In other words, it is a

Betting on recurring payments can be highly profitable for your company. If you want to

Have you ever strolled into your garage and thought you could do something else new

Setting up a Self-Managed Super Fund (SMSF) can offer financial independence and greater control over

Transferring shares from one demat account to another is a common requirement for investors. Whether

The field of conveyancing, like many other industries, is experiencing significant transformations due to technological

Revolutionizing Payments: How Smart Check Printing Empowers Modern Businesses

Revolutionizing Payments: How Smart Check Printing Empowers Modern Businesses  Understanding the Document Requirements When Filing Taxes

Understanding the Document Requirements When Filing Taxes  What are the best gift cards for subscription services?

What are the best gift cards for subscription services?  Different ways to pay for your plastic surgery procedure

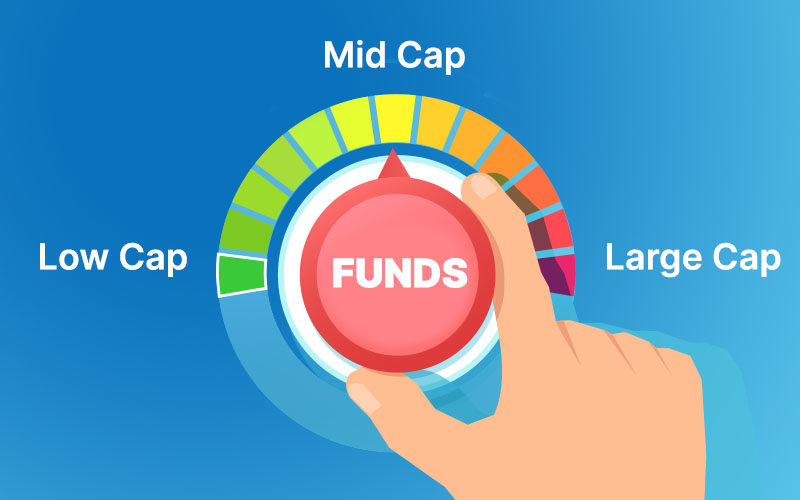

Different ways to pay for your plastic surgery procedure  Benefits of Investing in Mid-Cap Funds

Benefits of Investing in Mid-Cap Funds  Why Funding Partnerships Demand Personal Guarantors and How A Funding Partnership Agency Can Help

Why Funding Partnerships Demand Personal Guarantors and How A Funding Partnership Agency Can Help  How to Avoid Common Financial Mistakes That Hurt Your Wealth

How to Avoid Common Financial Mistakes That Hurt Your Wealth  Bank Nifty Index and Best Demat Account Apps for Trading

Bank Nifty Index and Best Demat Account Apps for Trading  Essential Trading Tools Every Forex Trader Should Use in 2025

Essential Trading Tools Every Forex Trader Should Use in 2025